A Huge Number of Payment Methods Through a Single-point

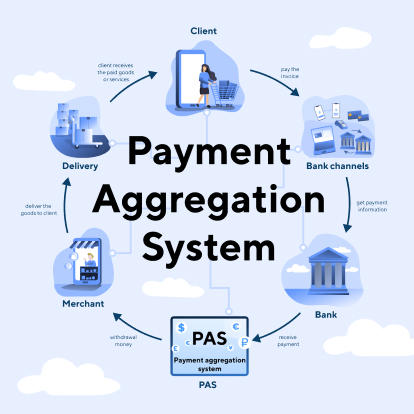

Payment Aggregation System (PAS) is an IT service, which is a single-point connection to various banks with a corresponding set of payment methods.

The seller of goods/services, having completed integration with the payment system, gains access to a large number of payment methods using the technical capabilities of the IT service.

This, in turn, allows customers to pay for goods/services using the most convenient and popular methods, so the sales volume is growing.

An additional advantage of integration with the payment system is that the seller (merchant) doesn't waste his time on technically complex integration with information systems of banks, as this has already been done by technical specialists and developers of the payment service.

The Process of Interaction

The process of interaction of all participants is arranged like this:

- Customer logins to the merchant's online store and places an order: selects goods and indicates a convenient payment method.

- Merchant sends a request to the PAS to create an invoice so that the customer could pay for the formed order.

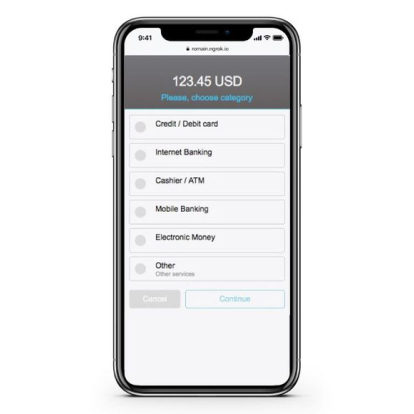

- PAS, depending on the payment method specified in the order, generates an invoice and sends it to merchant in one of the following forms:

- QR code - for paying via a mobile bank;

- Bill payment Pay-In Slip - for paying via ATM/cashier;

- Link to the bank's web account - the client can use it to enter his bank account, see all the parameters for payment and make it;

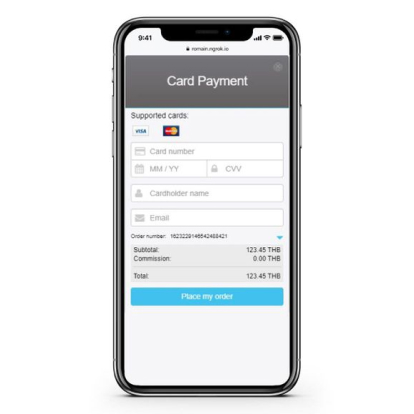

- Form for entering bank card details - when choosing to pay by card.

- Merchant sends an invoice to the customer for making payment.

- Customer immediately or after some time (except for the card payment method) goes through the invoice to the payment form and, after filling it out, sends a payment request to the bank.

- Bank sends a request to the PAS about the possibility of accepting payment on this account, and PAS first checks the possibility on its side: whether this order has already been paid earlier and whether the order has expired (TTL depends on the payment method).

- PAS additionally checks the possibility of accepting payment on merchant's side: whether the order has been canceled, whether it has been paid in another way, whether the product/service is available, etc. (depends on the business logic on merchant's side).

- Merchant checks and responds to the payment system whether or not the payment can be accepted.

- PAS sends a response to the bank about the possibility of accepting the payment.

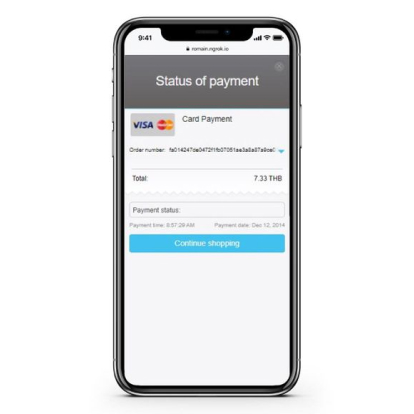

- The bank completes the payment transaction and notifies merchant and the payment system about the status.

- PAS reports the status of the payment to the merchant.

- Merchant notifies the customer about the status of the payment and his order.

- When the hold period expires, the seller can withdraw money from the merchant’s account in PAS in real-time 24/7.

Integration Options

PAS provides the merchant with several options for integration, from simple plug-in installation for popular ecommerce platforms to full integration via API or SDK with the ability to fine-tune all parameters. The following plug-ins for popular CMSes available in PAS:

Prestashop

Drupal